Award-winning PDF software

Wsib registration for self employed Form: What You Should Know

Register your business with us: Register Online When you register, you're not locked into your current business structure. It's one-time online registration to make sure you are registered for the ESIB program. Once registered, you can then use your ESIB Registration Certificate as evidence that you meet the requirements of the Industry Protection and Employment Insurance Act. For example, if you hire an ESIB eligible worker. Register your business with ESIB When you register your business online, your online payment status goes from inactive to active and stays active for 28 weeks from the date you register. Your registration status remains active if you have a claim or have been covered by ESIB Insurance and that's for five consecutive weeks. You may have to log-in or out to keep the status active during this time. The fee is now 100 and the form is now available Online. The online certificate is available by the final bill date of your invoice. We no longer make our payment online. You may opt in to pay by Credit Card, Check or Wire transfer. Payroll — ESIB All employees and independent contractors, including contractors and suppliers, who are covered by the ESIB, are the responsibility of their employer or a designated director in the case of companies and other legal entities. If you are a part of an enterprise or the majority of your employees are ESIB eligible, each eligible person is your responsible person and is responsible for any payroll, benefit and social assistance deductions they should pay through the Employment Insurance program. The ESIB payments are made electronically. Payroll by Online Check — ESIB When you register for ESIB with us, we make a direct deposit to the Bank of Nova Scotia. For more information about that option, click here. Online Payroll Services — ESIB If you are self-employed, you may still choose to register your business by using the Online payroll service. This is an easy, secure way for you to pay your staff, and record your monthly payroll, including your employment insurance payments. For an application or to register, click here. For more information. Call 1.877.224.4523 today to find out how you can register your business with us. You can also call the ESIB toll-free at 1.800.659.

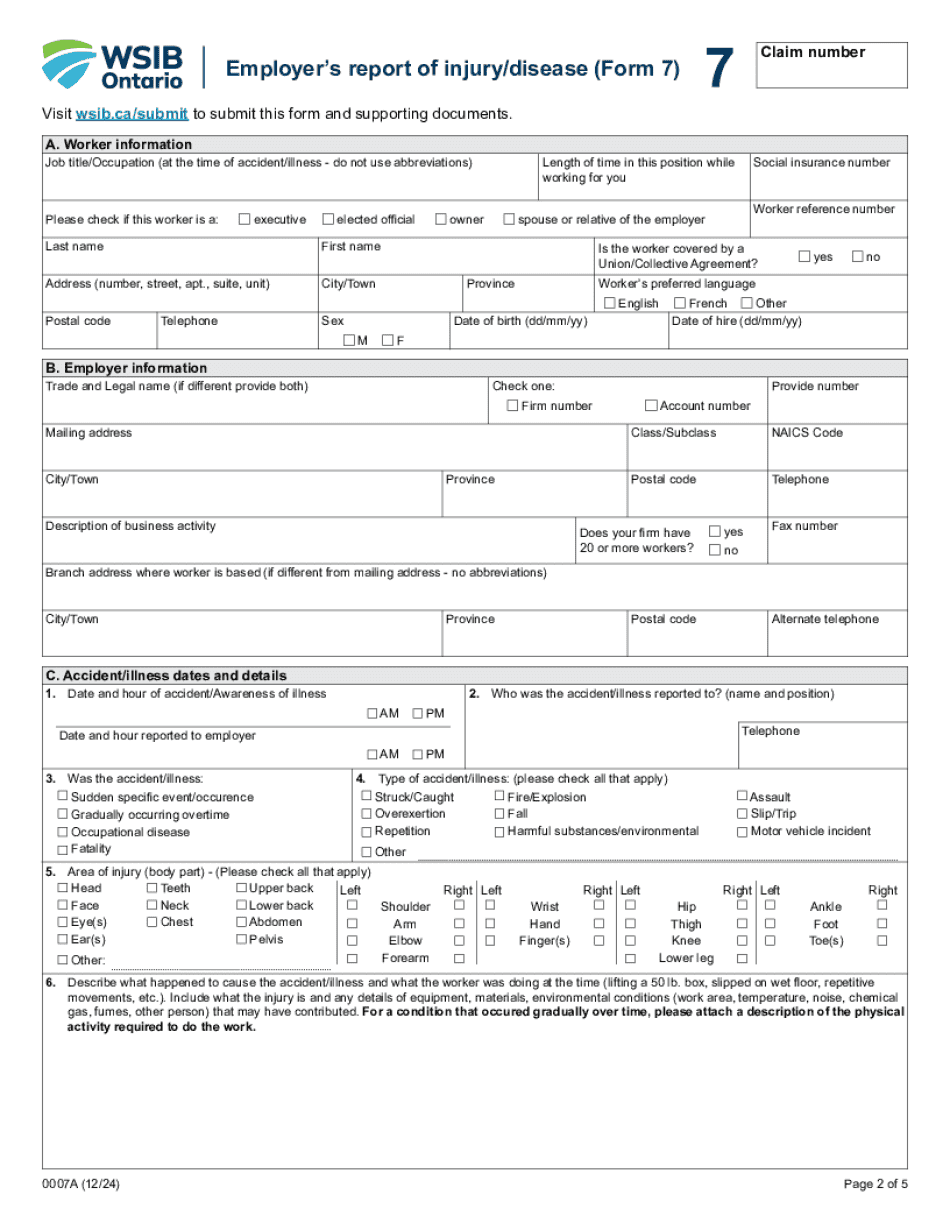

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Canada Wsib 7, steer clear of blunders along with furnish it in a timely manner:

How to complete any Canada Wsib 7 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Canada Wsib 7 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Canada Wsib 7 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.