The WSIB is giving millions of dollars in rebates to employers who have caused harm or death to workers. This is done through the experience rating system, which is supposed to encourage better health and safety practices by employers. However, there is no evidence that these programs actually work. In 2011 through 2013, we analyzed data for employers convicted of serious offenses. Shockingly, 78 of these employers received rebates from the WSIB in the same year they committed their offenses, totaling nearly fifteen million dollars. Additionally, sixty-nine employers received rebates in the same year as their convictions, amounting to over eleven million dollars. One particularly disturbing example is the gold car, the world's largest gold company. In 2011, an employee was killed, and in 2012, gold car was fined only three hundred and fifty thousand dollars. Then in 2013, they received a massive rebate of 2.7 million dollars from the WSIB, seven times the amount of their fine. One major problem with the experience rating system is that employers can manipulate their claims costs through claim suppression, hiding or discouraging claims, and claims management. When employers take aggressive legal approaches to deny injured workers' claims, it further highlights the failings of experience rating. Every December, I attend a heartbreaking demonstration outside the Ministry of Labor at 400 University Avenue. These are injured workers, living below the poverty line because of accidents that were not their fault. This "no fault" system has left them without adequate support, as they have not received even the rate of inflation increase in their benefits for over a decade. It is clear that we need significant changes. The current system should be scrapped, the CEO at WSIB should be replaced, and the money saved should be reinvested into workplace health and safety programs. Additionally, injured...

Award-winning PDF software

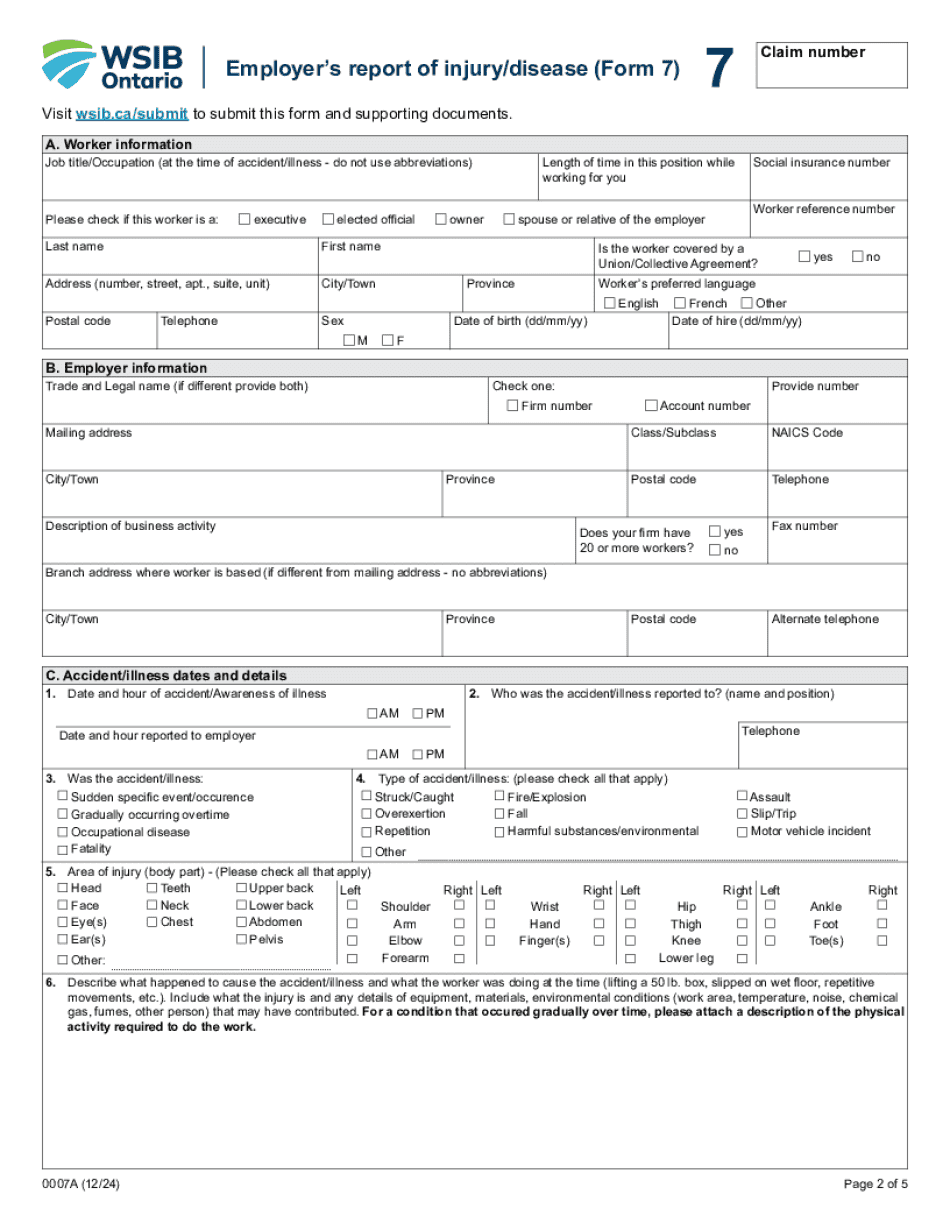

Wsib 6 vs 7 Form: What You Should Know

Form 7 (Employer's Report of Injury Disease) — ESIB The first two digits of this nine character number are your calendar year, followed by the last four characters your address. Form 7 (Employer's Report of Injury Disease) — ESIB Two-digit number to identify whether the injury is self-inflicted. (self-inflicted injury is the lowest form, non-self-inflicted injuries are higher) Form 7 (Employer's Report of Injury Disease) — ESIB The third, fourth, or fifth digit from the left identifies if it is the first, second or third accident or the fourth or later accident. Form 7, page 4 — ESIB One to twelve-digit number for each month of the calendar year (January – December) Form 6, page 2 — ESIB One to ten-digit number to identify yourself Form 6, page 2 — ESIB One to twenty-six-digit number if you are an employee (work-eligible) Form 6, page 2 — ESIB Employee's name and address Employer's report of injury disease (Form 7) — ESIB The Employer's Report of Injury Disease (Form 7) forms the basis for claims to the ESIB. Form 7, page 2 — ESIB One to fourteen-digit number for each month of the calendar year, unless the accident occurred in a year that was not reported in a previous (other) Form 7. Form 7, page 17 ESIB Fully descriptive personal information for every person involved, including the employee and any other people involved (e.g. nonfamily members including a spouse) If you have a question or concern about where this information may be located, please contact the ESIB Toll-free at, or by email at. The ESIB does not provide any warranty, guarantee, or representation as to the accuracy or completeness of the information provided. EIC (Electronic Insurance Claim Form) If you make a claim after you complete your Form 5, you must submit you EIC (Electronic Insurance Claim Form), which is available on the ESIB “forms and information” page.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Canada Wsib 7, steer clear of blunders along with furnish it in a timely manner:

How to complete any Canada Wsib 7 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Canada Wsib 7 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Canada Wsib 7 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Wsib Form 6 vs Form 7