And I'm an admissions counselor at Indiana Tech. I'm here to help you complete your remittance information form. Basically, the remittance information form is a required form by Indiana Tech to ensure that you have the most up-to-date and current bill available. It also lets us know if there is a balance and if you have a plan in place to pay off your bill. To access the form, you need to sign into your my Indiana Tech account, similar to waiving your insurance information and filling out your information release. Once you're signed in, click on the "my account" tab to go to the my account page. Scroll down a bit on the right-hand side, just below the student health insurance waiver form and information release form, and you'll find the business office remittance information form. Click on that. You'll then see a big banner that says Indiana Tech. Click next page, and that will take you to the remittance form. Read the statement above to make sure you understand it. Sometimes, you may need to read it twice. After understanding the statement, click the "yes, I understand" button. Next, you'll need the most up-to-date bill that you have received from us. Use that bill to find the final balance that you owe. The bill should have the amount at the very bottom, and it should also include the date of the invoice at the top. If you are declining any loans, please notify us on line six. You can simply type "no, I'm keeping my aid" if you are not declining any loans. If you are declining loans, specify the ones you are declining and the amount of each one. On line nine, subtract the declined loans from the final bill on line five. If you are keeping all of...

Award-winning PDF software

Wsib premium remittance 2024-2025 Form: What You Should Know

In 2019, we will adjust premium rates to achieve our target actuarial balance. Premiums paid in 2025 are not included in the projection (see below). Published. April 17, 2017, for all businesses | ESIB. How to report and pay your premium for 2025 — ESIB Premium amounts received will be adjusted to ensure they will be actuarial balanced. In 2019, we will adjust premium rates to achieve our target actuarial balance. Any amounts received in 2025 will not be included in our 2025 projection. Published. June 16, 2020. Calculate and report your premium using the bottom portion of the remittance form and mail it with your payment using the return envelope. Premiums not reported If you received a premium payment in 2019, you can report and pay it if: you are the business owner at the time the premium was paid or if you are the business owner's employee, the employee's employer at the time the premium was paid and, the employee was: at any time during 2025 that the employee was receiving compensation of 1,000 or more from the business owner or, the employee received compensation in 2025 from the business owner at any time during 2025 that the employee was receiving compensation at least 1,000 from the business owner and, if you are the business owner or employee, the business owner or employee had a premium payment on record at the time the premium was paid Note: These dates aren't final, and it's not possible to know precisely what will happen in 2019. Only Premium Remittance claims received between June 16, 2018, and February 24, 2019, will be accepted for 2025 premium amounts. Premium-receipted premium amounts will be adjusted to ensure actuarial balanced premiums in 2020. In 2019, we will adjust premium amounts to achieve our target actuarial balance. Any amounts received in 2025 will not be included in the 2025 projection. This is the date for payments received in 2019: Premium payments received in 2025 will not be included in our 2025 estimate until January 1, 2020.

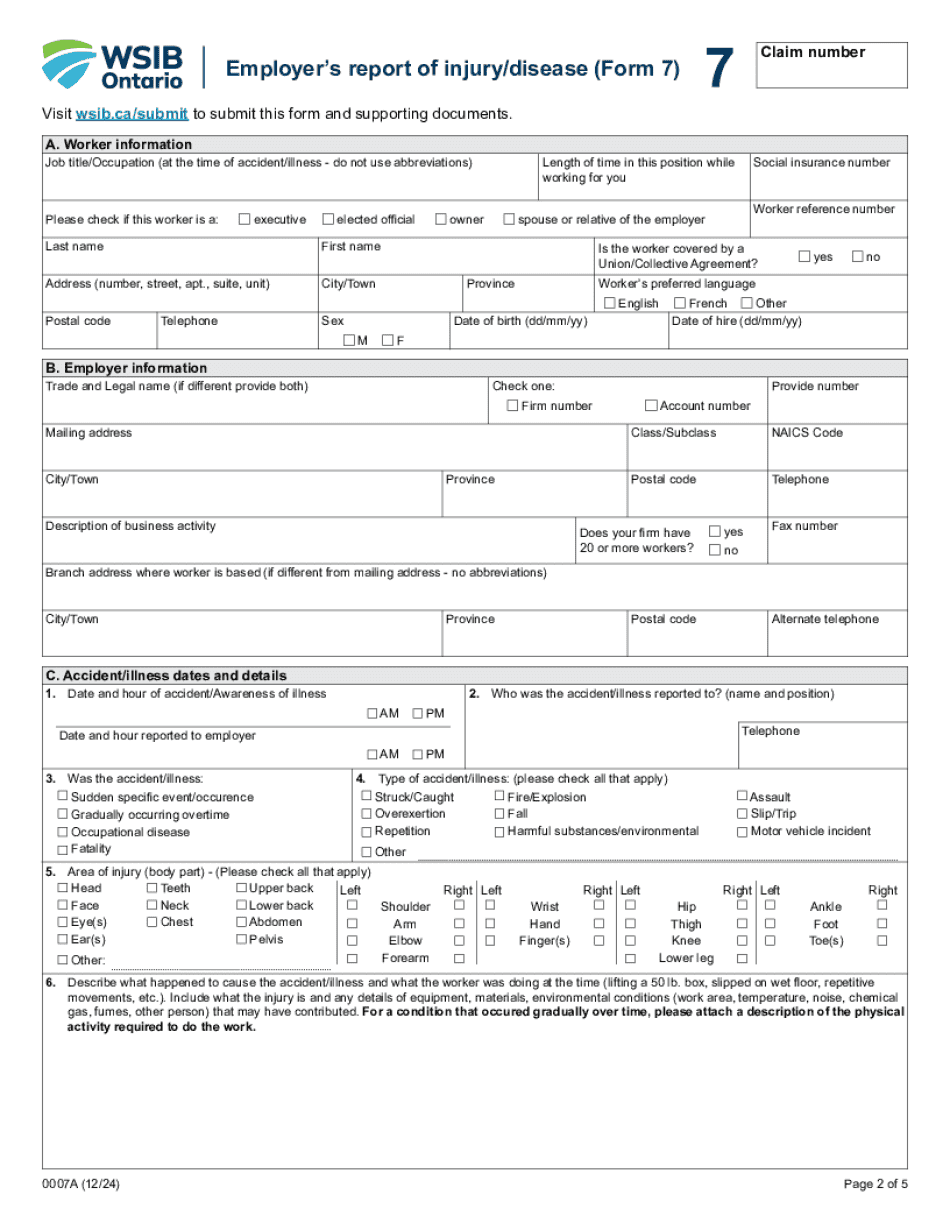

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Canada Wsib 7, steer clear of blunders along with furnish it in a timely manner:

How to complete any Canada Wsib 7 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Canada Wsib 7 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Canada Wsib 7 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Wsib premium remittance form 2024-2025